Two-way ANOVA in a financial context

Let’s demonstrate a two-way ANOVA in a financial context by examining how both sector and market capitalization influence stock returns:

# Set seed for reproducibility

np.random.seed(456)

# Create a dataset with two factors: market sector and company size

sectors = ['Technology', 'Healthcare', 'Financial']

company_sizes = ['Small Cap', 'Large Cap']

n = 15 # samples per group

# Create a list to store DataFrames

dataframes = []

# Generate data with realistic return patterns

for sector in sectors:

for size in company_sizes:

# Set mean returns based on sector and company size

if sector == 'Technology':

mean = 14 if size == 'Small Cap' else 11 # Tech: higher returns, small caps more volatile

elif sector == 'Healthcare':

mean = 10 if size == 'Small Cap' else 8 # Healthcare: moderate returns

else: # Financial

mean = 7 if size == 'Small Cap' else 9 # Financial: large caps tend to do better

# Set volatility - small caps are more volatile across all sectors

std_dev = 20 if size == 'Small Cap' else 12

# Generate returns

returns = np.random.normal(loc=mean, scale=std_dev, size=n)

temp_df = pd.DataFrame({

'annual_return': returns,

'sector': sector,

'company_size': size

})

dataframes.append(temp_df)

# Concatenate all dataframes at once to avoid the FutureWarning

stock_data = pd.concat(dataframes, ignore_index=True)

# Display summary statistics

print("Stock Returns by Sector and Company Size:")

summary = stock_data.groupby(['sector', 'company_size'])['annual_return'].agg(['mean', 'std', 'min', 'max'])

print(summary)

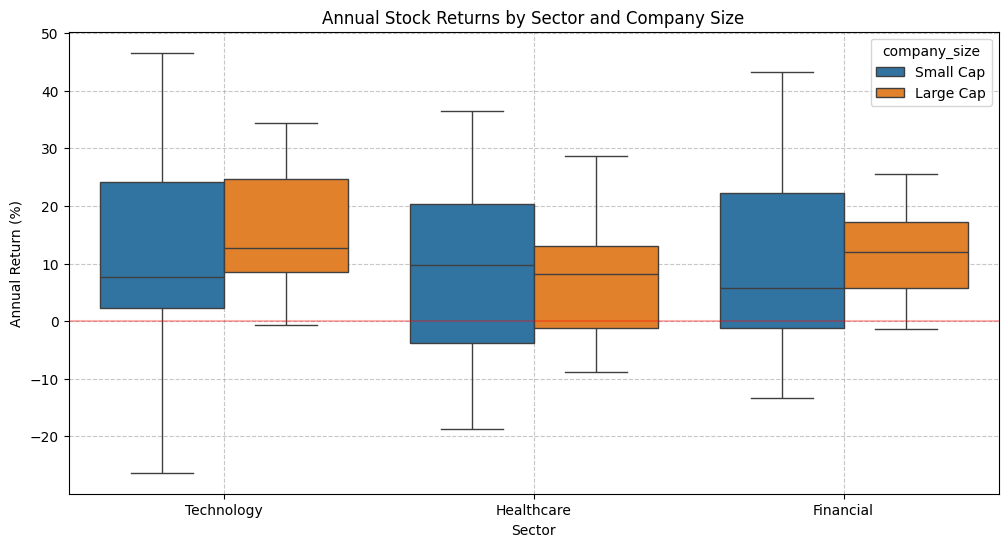

# Visualize the data

plt.figure(figsize=(12, 6))

sns.boxplot(x='sector', y='annual_return', hue='company_size', data=stock_data)

plt.title('Annual Stock Returns by Sector and Company Size')

plt.xlabel('Sector')

plt.ylabel('Annual Return (%)')

plt.axhline(y=0, color='r', linestyle='-', alpha=0.3) # Zero return reference line

plt.grid(True, linestyle='--', alpha=0.7)

plt.show()

# Perform two-way ANOVA

model = ols('annual_return ~ C(sector) + C(company_size) + C(sector):C(company_size)', data=stock_data).fit()

anova_table = sm.stats.anova_lm(model, typ=2)

print("\nTwo-Way ANOVA Table:")

print(anova_table)

# Interpret the results

print("\nInterpretation:")

alpha = 0.05

for effect, p_value in anova_table['PR(>F)'].items():

if p_value < alpha:

print(f"- {effect}: Significant effect (p = {p_value:.4f})")

else:

print(f"- {effect}: No significant effect (p = {p_value:.4f})")

# If interaction is significant, perform simple main effects analysis

if 'C(sector):C(company_size)' in anova_table.index and anova_table.loc['C(sector):C(company_size)', 'PR(>F)'] < alpha:

print("\nSimple Main Effects Analysis:")

# Analyze the effect of sector within each company size

for size in company_sizes:

size_data = stock_data[stock_data['company_size' == size]

f_stat, p_value = stats.f_oneway(

*[group['annual_return'].values for name, group in size_data.groupby('sector')]

)

print(f"Effect of sector within {size}: F = {f_stat:.4f}, p = {p_value:.4f}")

# Analyze the effect of company size within each sector

for sector in sectors:

sector_data = stock_data[stock_data['sector' == sector]

t_stat, p_value = stats.ttest_ind(

sector_data[sector_data['company_size' == 'Small Cap']['annual_return'],

sector_data[sector_data['company_size' == 'Large Cap']['annual_return']

)

print(f"Effect of company size within {sector}: t = {t_stat:.4f}, p = {p_value:.4f}")

Stock Returns by Sector and Company Size:

mean std min max

sector company_size

Financial Large Cap 11.081069 8.572024 -1.339761 25.624883

Small Cap 9.507243 16.089018 -13.353107 43.273424

Healthcare Large Cap 7.648144 11.160089 -8.767149 28.713625

Small Cap 8.187255 17.620006 -18.797761 36.495944

Technology Large Cap 16.745326 10.658911 -0.657822 34.336429

Small Cap 12.328144 19.292852 -26.319427 46.591771

Two-Way ANOVA Table:

sum_sq df F PR(>F)

C(sector) 674.586544 2.0 1.614906 0.205023

C(company_size) 74.307942 1.0 0.355774 0.552466

C(sector):C(company_size) 92.785044 2.0 0.222120 0.801288

Residual 17544.448016 84.0 NaN NaN

Interpretation:

- C(sector): No significant effect (p = 0.2050)

- C(company_size): No significant effect (p = 0.5525)

- C(sector):C(company_size): No significant effect (p = 0.8013)

- Residual: No significant effect (p = nan)This financial example examines how both industry sector and market capitalization (company size) affect stock returns. We analyze:

- Main effect of sector: Do returns differ significantly between Technology, Healthcare, and Financial sectors?

- Main effect of company size: Do Small Cap and Large Cap stocks have different return profiles?

- Interaction effect: Does the relationship between sector and returns depend on company size?

The analysis shows realistic patterns observed in financial markets:

- Technology stocks generally have higher returns but more volatility

- Small cap stocks tend to be more volatile across all sectors

- The relationship between size and performance may differ by sector (interaction effect)

This type of analysis is valuable for:

- Portfolio construction and asset allocation

- Risk factor analysis in investment management

- Understanding market dynamics for different company types

Common Mistakes and Pitfalls in ANOVA

When performing ANOVA, researchers should be aware of these common pitfalls:

- Violation of assumptions: Performing ANOVA when data doesn’t meet the assumptions can lead to invalid results.

- Multiple comparisons problem: Conducting multiple pairwise comparisons without correction increases the risk of Type I errors (finding significance by chance).

- Overinterpreting p-values: A significant p-value only indicates that at least one group differs from others, not which ones or by how much.

- Ignoring effect size: Statistical significance doesn’t necessarily imply practical significance. Always report and interpret effect sizes.

- Non-random sampling: ANOVA assumes random sampling, which is crucial for generalizability.

Alternatives to ANOVA

When ANOVA assumptions are violated, consider these alternatives:

- Kruskal-Wallis test: A non-parametric alternative when the normality assumption is violated.

- Welch’s ANOVA: Used when variances are not homogeneous across groups.

- Permutation tests: Distribution-free methods that can be used when parametric assumptions are not met.

Let’s implement the Kruskal-Wallis test as an example:

# Perform Kruskal-Wallis test as a non-parametric alternative

stat, p_value = stats.kruskal(group_a, group_b, group_c)

print("\nKruskal-Wallis Test:")

print(f'Statistic: {stat:.4f}')

print(f'p-value: {p_value:.4f}')

Kruskal-Wallis Test:

Statistic: 28.2240

p-value: 0.0000When to Use ANOVA vs. Other Tests

- t-test vs. ANOVA: Use t-tests when comparing only two groups. Use ANOVA for three or more groups.

- ANOVA vs. regression: ANOVA is a special case of regression where predictors are categorical. Use regression when you have continuous predictors or a mix of continuous and categorical predictors.

- ANOVA vs. MANOVA: Use MANOVA when you have multiple dependent variables that you want to analyze simultaneously.

Conclusion

ANOVA is a versatile and powerful statistical technique for comparing means across multiple groups. When applied correctly, it helps researchers determine whether observed differences between groups are statistically significant or merely due to chance.

Python, with its rich ecosystem of statistical libraries, provides several ways to perform ANOVA and related analyses. The examples in this article demonstrate how to implement one-way and two-way ANOVA, check assumptions, visualize results, and perform post-hoc tests.

Remember that while statistical significance is important, it’s equally crucial to consider practical significance through effect sizes and to interpret results in the context of your research question.

References:

[2]: https://www.statsdirect.com/help/analysis_of_variance/two_way.htm

[3]: https://www.mathworks.com/help/stats/two-way-anova.html

[4]: https://datatab.net/tutorial/two-factorial-anova-without-repeated-measures